Business Education

Webinars, blogs, and more

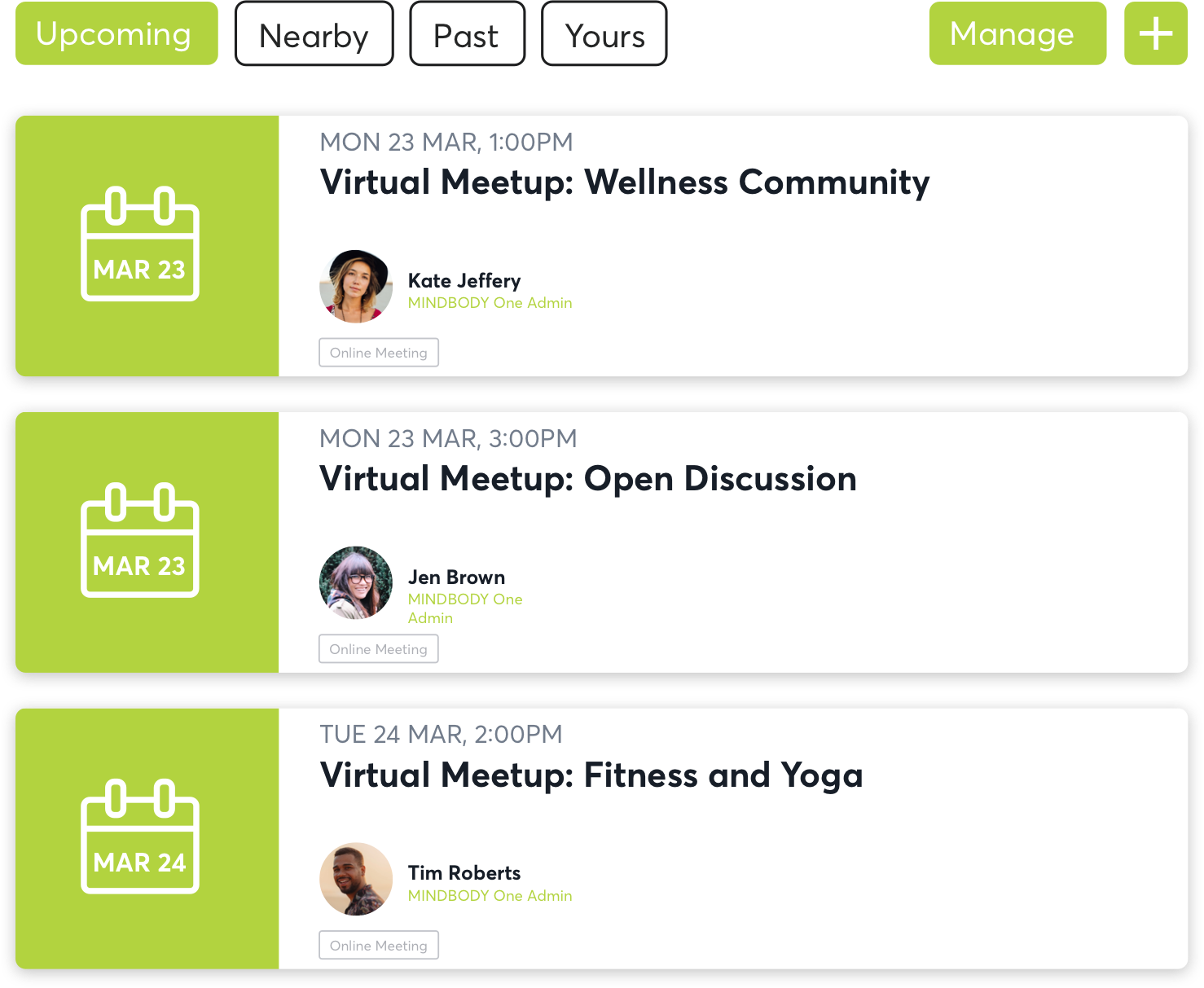

Mindbody One is here for you

Connection is more important now than ever. The Mindbody One community wants to help you find other business owners experiencing the same challenges that you are. Ask questions, share feelings, and get advice from people who truly understand.

New resources, straight to your inbox

Get updates on the latest industry trends, tips, and news.